|

Slow Debt, Deep Recessions

(with Immo Schott)

American Economic Journal: Macroeconomics, Vol. 14(1), January 2022, pp. 224-259

Working Paper

Business credit lags GDP growth by about one year. This contributes to high

leverage during recessions and slow deleveraging. We show that a model in which

firms use risky long-term debt replicates this slow adjustment of firm debt. In the

model, slow-moving debt has important effects for real activity. High levels of firm

debt issued during expansions are only gradually reduced during recessions. This

generates an adverse feedback loop between high default rates and low investment

and thereby amplifies the downturn. Sluggish deleveraging slows down the recovery.

The equilibrium is constrained inefficient because firms exert an externality on the

holders of previously issued debt. The constrained efficient allocation substantially

reduces macroeconomic volatility.

|

|

Optimal Debt Maturity and Firm Investment

(with Immo Schott)

Review of Economic Dynamics, Vol. 42, October 2021, pp. 110-132

Working Paper

We introduce long-term debt and a maturity choice into a dynamic model of

production, firm financing, and costly default. Long-term debt saves roll-over costs

but increases future leverage and default rates because of a commitment problem.

The model generates rich distributions of maturity choices, leverage ratios, and

credit spreads across firms. It explains why larger and older firms borrow at longer

maturities, have higher leverage, and pay lower credit spreads. Firms' maturity

choice matters for policy: A financial reform which increases investment and output

in a standard model of short-term debt can have the opposite effect in a model

with short-term debt and long-term debt.

|

|

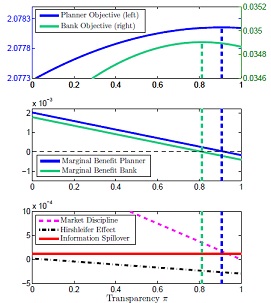

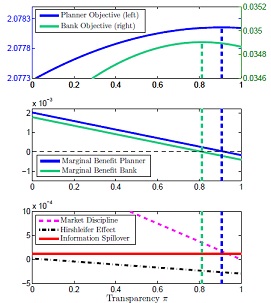

Bank Opacity and Financial Crises

Journal of Banking & Finance, Vol. 97, December 2018, pp. 157-176

Working Paper;

Barcelona GSE Focus

This paper studies a model of endogenous bank opacity. Why do banks choose to hide their risk

exposure from the public? And should policy makers force banks to be more transparent? In the model,

bank opacity is costly because it encourages banks to take on too much risk. But opacity also reduces

the incidence of bank runs (for a given level of risk taking). Banks choose to be inefficiently opaque

if the composition of their asset holdings is proprietary information. In this case, policy makers can

improve upon the market outcome by imposing public disclosure requirements (such as Pillar Three of

Basel II). However, full transparency maximizes neither efficiency nor stability. The model can explain

why empirically a higher degree of bank competition leads to increased transparency.

|